- Data-backed Insight: Should you try to time the market?

- Investing: Position sizing helps to live another day

- Psychology: Being rational when shit is hitting the fan is easier said than done

- IPO: A much-needed context of Oyo’s private valuation before the IPO

- US Markets: Software stocks got hammered. Are they value buys now?

- Pop Poll: In which stock have you lost the most money?

(Flash Sale – Get started with Capitalmind this new Financial Year. 23% instant discount code at the end)

Is it the right time to Invest? 👀

In the last 2 years, markets have been through a shutdown economy during the pandemic, braved a steep crash, embraced inflation woes, and most recently, climbed the wall of worry related to the Russia Ukraine war. The markets have never felt more overvalued and they still keep inching up.

So, once more, the most asked question is: Is this a good time to invest? In other words, how do I not be the shmuck who bought at the top?

Read – On Market Timing: What if you were the luckiest investor in India?

Position sizing is more important than alpha. There, said it 💪

Position sizing – as a concept – is boring. You’ll rather read about a fancy microcap stock than spend 10 minutes understanding how to appropriately allocate to different stocks (or assets). It’s not just you. It’s all of us.

To make this interesting here’s a real-life example of how a portfolio outperforms the market the same year in which it suffered an 87% loss on a single position.

Read – Bill Miller’s Biggest Loss

(And if you want to check out a simple (read boring) position sizing framework for sorting out your portfolio. Reply back with a “YES”)

Private markets meet public markets (IPO) 🤹🏻

Not too long ago we would read about outrageous valuations enjoyed by cash-burning startups. We would smirk about it and order our pizza that was subsidized by the likes of Tiger Global and Soft Bank. It was all fine to us when institutions valued each other the way they wanted because it didn’t impact us – at least directly.

But now, these startups have started approaching the public markets and it’s more difficult than ever to determine their true valuations. News about Oyo IPO is making rounds and so this read becomes all the more relevant.

Read – Crouching Tiger, Hidden Problems

Thinking clearly is simple. Not easy 🤔

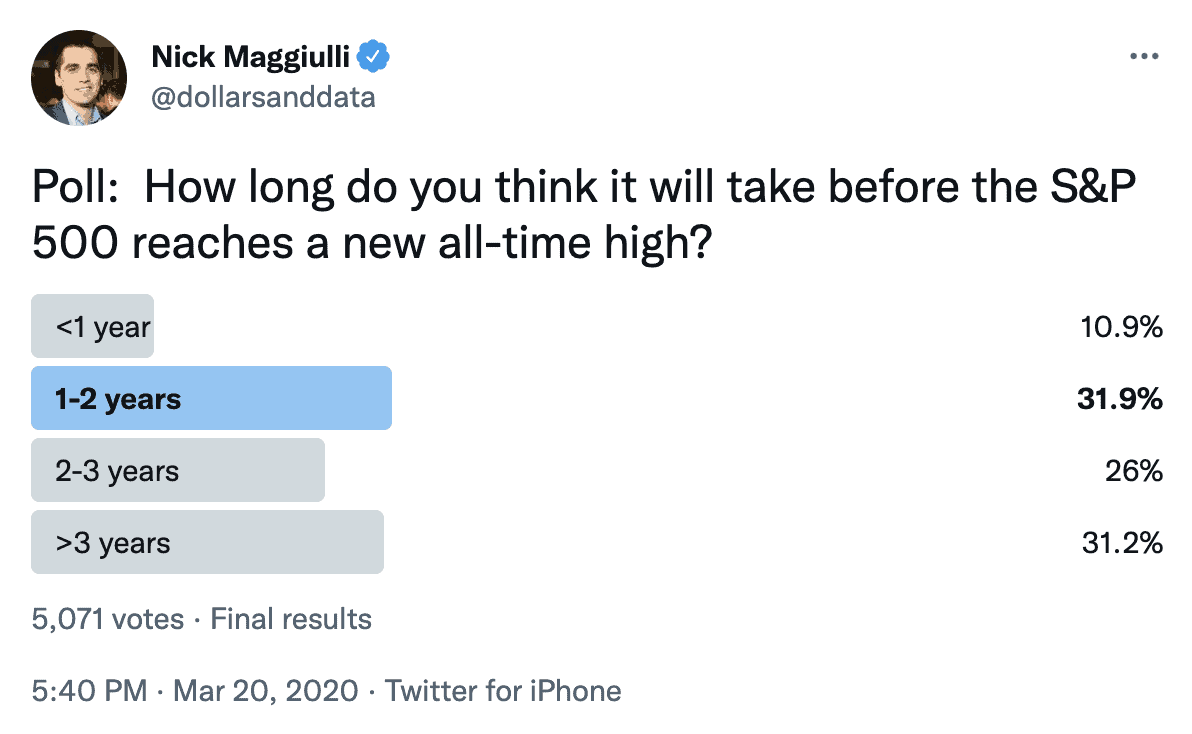

Two years ago today the world was in a panic. The U.S. stock market was nearly 33% off its highs (the largest decline since 2008/2009) and no one knew what would come next. Around that same time, the author started to wonder how long it might take for the market to recover. So he asked Twitter and these were the results. No one thought that the market would bounce back so early. But it did.

Read – When the Optimists are Too Pessimistic

Software growth hype goes puff 💨

The hammering of “high flier” software stocks got overshadowed by the Russia Ukraine war. These stocks dived from their highs and have broken the dream run that started after the Covid crash of March 2020. This post puts into perspective the scale of the fall, the current valuations these companies trade at and compares the current scenario with earlier tech boom cycles.

Pop Poll – a very personal question 😅

In which stock have you lost the maximum amount of money? (till now)

Answer: _______

Click here to answer anonymously

Last week’s poll results💡

Total responses = 261

- 69% of respondents would want to achieve their goals through higher returns

- Even the ones who prefer “investing more” over “returns” want to achieve goals with higher returns

It seems that achieving a goal is sweeter when it’s through higher returns. Money is just not a number then. Interesting!

New Financial Year.. Start something new!! ⚡️⚡️

Only till the weekend, we are running a 20% discount on annual plans for all our products.

Capitalmind Premium: Subscribe Here

Momentum Smallcase – Start Investing

Focused Smallcase – Start Investing

Low Volatility Smallcase – Start Investing

(Flash Sale: Use code SIMPLIFY23 for a 23% discount on the annual plan)