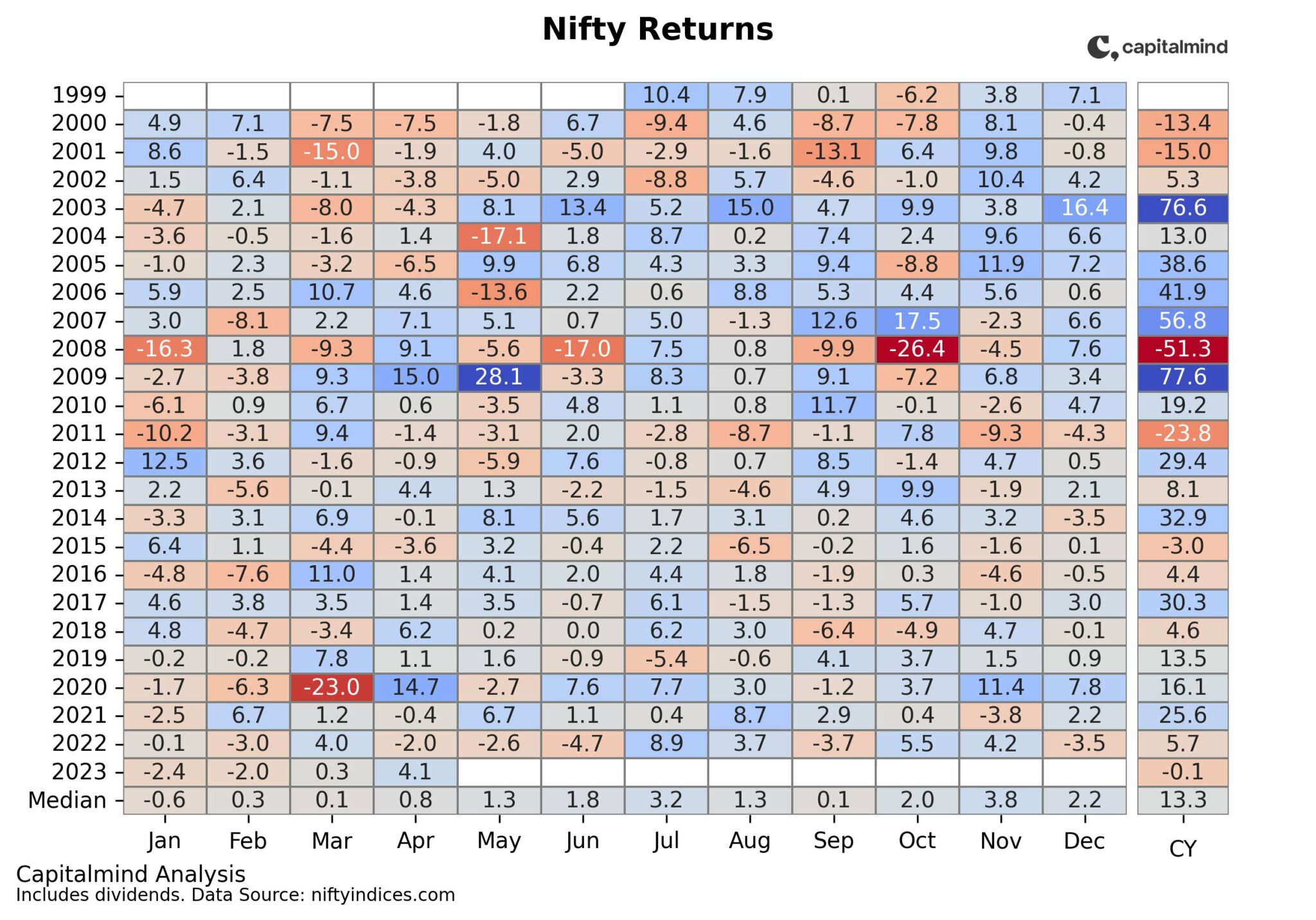

The Nifty has run up a bit, but how high is it in terms of an earnings multiple? And how do returns look from here?

If you look at a Price to Earnings Ratio (P/E) independent of anything else, it’s not very useful – because the earnings growth might actually be spectacularly high, or expected to be. But at some point, the P/E becomes useful even as a number – when it’s too high relative to its own history, it might just be a bubble building up.

The Nifty is now at a P/E of 23. This is high, but still below highs of 2015/16 where we saw it beyond 24. If, in the past, you had bought the Nifty when it was at a P/E of 23, then you would see:

- Average 1 year returns of -10%

- Average 3 year returns of -1.89% (annualized)

- Average 5 year returns of 6.94% (annualized)

- Average 7 year returns of 12.12% (annualized)

- Average 10 year returns of 13.44% (annualized)

The longer term returns have little data though, since we only have P/E data since 1999, so it’s really been one earnings cycle.

Here’s how returns have been if you invested at different P/E multiples, on average:

Earnings growth as a whole is up just 2.6% but the cycle seems to be turning.

If we look at Q3 alone, the Nifty companies saw a 17% increase in aggregate profit! (Mostly due to a low base and the oil companies turning a profit, but still)

The market’s a little hot and it’s not exactly the best time to sell your neighbour’s house and invest. But it’s not super-highly valued either. A further increase in P/E, though, will probably make return probabilities reduce much more.

In Capitalmind Premium, we did this analysis with more indexes to see where the broader market P/E is, and how bubbly we seem to be. Do sign up! Use code CM2017 to get a 10% discount.