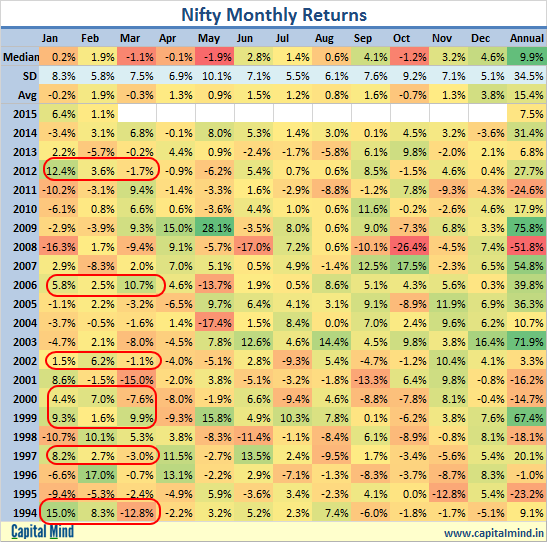

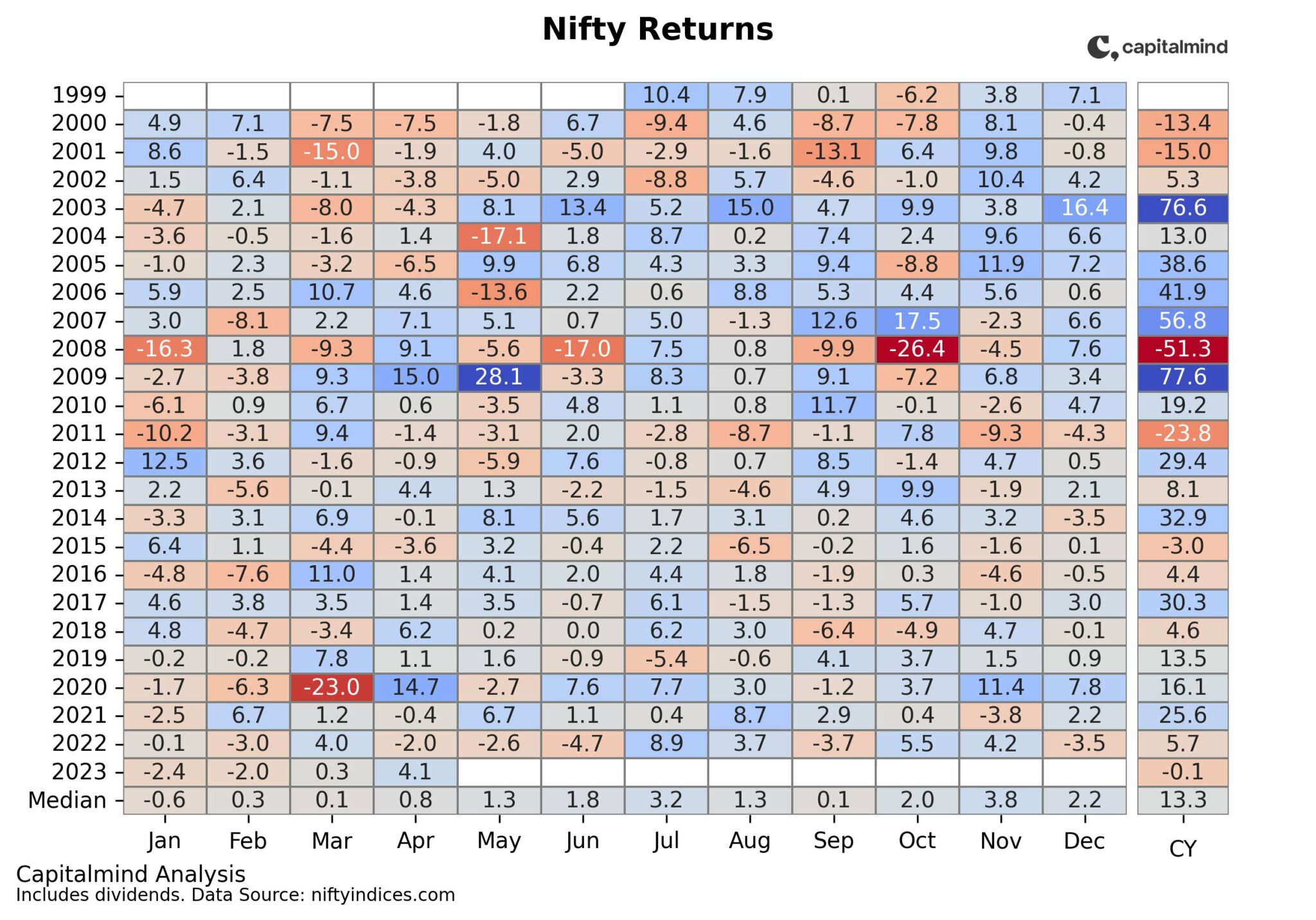

The Nifty went up 1.1% in Feb 2015, taking the 2015 return to 7.5%. With two consecutive months of gains, this looks like a good month. March has a negative average, and a negative median return (a new measure we add this month).

If you look at the years in which Jan and Feb have been positive, what does March Look Like?

In the seven instances (since 1994) that we have seen positive returns in Jan + Feb, we have:

- Five negative returns (from -1.1% to -12.8%)

- Two positive returns (+10.7% and +9.9%)

Just seven points don’t make for any useful statistics. But what they’re saying is: if March is positive, it’s blockbuster; but it’s more likely to be negative.

Note: Don’t draw this inference as a recommendation – with just seven past instances, you are quite likely to be wrong.

Subscribe to Capital Mind:

To subscribe to new posts by email, once a day, delivered to your Inbox:

[wysija_form id=”1″]

Also, do check out Capital Mind Premium, where we provide high

quality analysis on macro, fixed income and stocks. Also see our

portfolio which has given stellar returns in our year, trade by trade

as we progress. Take a 30-day trial:

[wysija_form id=”2″]