Exactly what is the RBI doing?

- It’s just conducted a reverse repo auction (where banks park cash with the RBI) for a whopping Rs. 45,663 cr. Banks have placed that much excess liquidity with the RBI till Friday, for about 7.88%. (This isn’t regular reverse repo which is at 7% – it’s a variable rate auction where banks bid at interest rates to place money withe the RBI)

- It has also sold Rs. 10,345 cr. of government bonds. That much money will go back to the RBI and thus, go out of the banking system.

In effect, this takes out around Rs. 56,000 cr. of liquidity from the system!

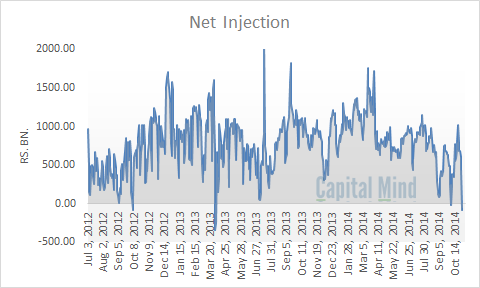

The net daily injection of money from the RBI has gone negative again (after a brief dip to below zero a month back). This is net of – the daily repo and reverse repo, the variable term reverse repo and repo auctions announced ad-hoc, and finally, the four term repo auctions conducted constantly.

In the week ended Oct 31, Reserve Money grew just 7.7%.

If RBI is taking liquidity out of the system it could be because:

- It’s buying dollars and thus adding money into the system and is using these mechanism (bond sales and/or reverse repo pull outs) to sterilize this flow. Otherwise we’ll have too many rupees and that’s inflationary.

- Banks are unable to lend out money and as credit growth falls, the excess money in banks has to be parked somewhere.

It’s probably the former – since the RBI is buying dollars and the dollar remains constant against the rupee even as inflows are at the highest. We have discussed this in a recent Capital Mind Premium letter with data and graphss.

But it could be a bit of the latter as well – with no credit growth banks will have to park excess cash somewhere.

When RBI takes such sudden and drastic action to shore up dollar reserves and pulls out liquidity we could be seeing the beginning of something way more sinister than is currently known. Typically such times come and go; but once in a while they end up being the effect of a huge festering crisis. Which one of these is happening today?

Subscribe to Capital Mind:

To subscribe to new posts by email, once a day, delivered to your Inbox:

[wysija_form id=”1″]

Also, do check out Capital Mind Premium , where we provide high

quality analysis on macro, fixed income and stocks. Also see our

portfolio which has given stellar returns in our year, trade by trade

as we progress. Take a 30-day trial:

[wysija_form id=”2″]