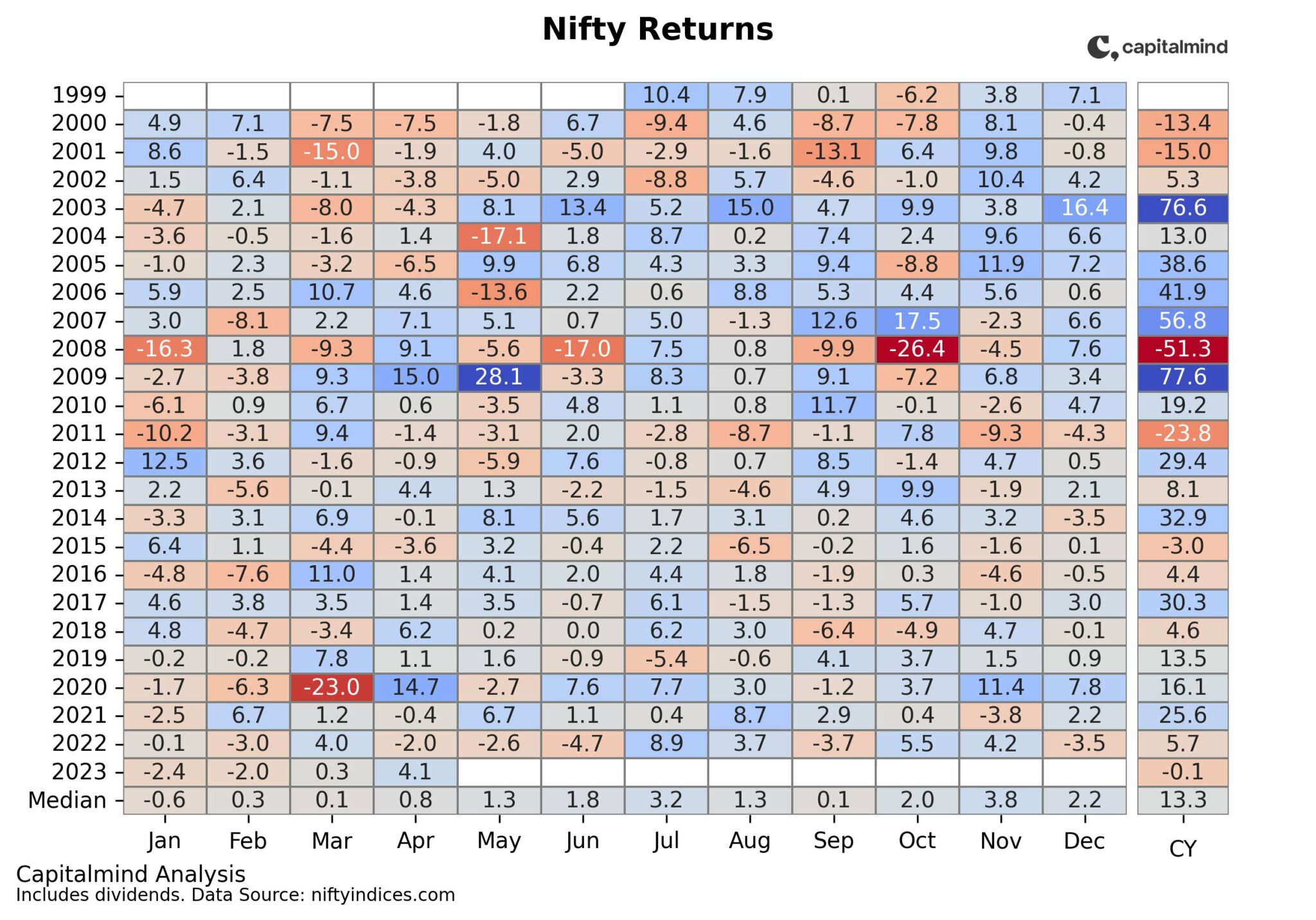

You don’t know how tough this market is until you’ve seen the carnage in the stuff that is not the Nifty. First,the broad Indexes this year:

While the Nifty looks really good and just 2.5% off the number that it closed on Dec 31, 2012, look at how badly the other set have done. Nifty Junior is the set of 50 stocks AFTER the top 50 – still very good stocks, just beyond the top 50. This is down nearly 10% for the year.

Midcaps – embodied by the Nifty Midcap 50 index – are not very large in market capitalization, and contains stocks like Bata, Tata Global, Punj Lloyd etc. This has fallen over 23% in 2013.

Smallcaps as an index contains many mid-caps as well. That one is –28% this year. The worst hit, by all measures.

And then, a look at the sectors:

The 2013 story is just about three sectors:

- IT (+28%)

- FMCG (+18%)

- Pharma (+17%)

Every other sector has underperformed the Nifty, and some by a huge margin. Metals is the worst, shaving more than 41% off this year. Stocks like Hindalco and Tata Steel have been hit hard.

Real estate stocks are digging themselves all the way to Canada. Banks, after looking good in April-May, have hurt big time in the last month, down over 18% for the year.

The Nifty’s being propped up by the defensives and IT exporters, and the stock market is being propped up by the Nifty. Everything else seems to have been bitchslapped out of existence.