When you hear comparisons of the Nifty with another investment, a mutual fund, or an insurance policy or such, you tend to look at their “outperformance” as something they’ve done right. However the pure Nifty return does not include dividends.

The Nifty is simply something based on the Market Capitalization of the largest stocks (weighted by their “free float” – i.e. non-promoter – market capitalization). When stocks provide dividends, an investor in the stocks can receive and reinvest those dividends back. The Nifty does not reflect this – the cash flow is somehow “lost”.

An investor in the Nifty stocks in the same proportion as the Nifty will see a better return than by just looking at the Nifty itself. Dividend yields have been very low – 1-2% a year. However, over a 5 to 10 year period, the outperformance can be significant.

The NSE publishes a Total Return Index which is the Nifty including dividends reinvested. Using that data, we can see how much dividends have impacted your return.

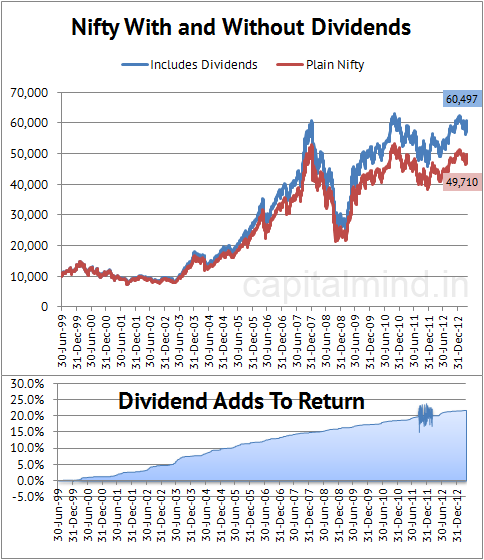

A 10,000 rupee investment in 1999 – the first time the Total Returns Index was published – would have given you Rs. 49,710 if you looked purely at the Nifty. This is a near 5x multiple – or a 397% return – in about 14 years.

However, the same amount including dividends reinvested gives you Rs. 60,497. The difference is the dividends that came in. The total return in the same 14 years, including dividends, is 505%.

(The squiggly bit must have been a data issue temporarily)

Dividends have added, in total, about 22% in 14 years, or about 1.5% a year. This isn’t much as the highest P/E stocks won’t pay you a great dividend yield.

Note: Why not? A high P/E means a high price to earnings – so a stock that has a 30 P/E is priced at Rs. 90 for a Rs. 3 net profit. Out of this Rs. 3, it will choose to retain Rs. 2 and pay out Rs. 1 as dividend – the yield on the price is about 1% (Rs. 1 dividend out of Rs. 90 price).

The Nifty’s average P/E has been around 16-18. However, in a low P/E time, dividend impacts will be high, if distribution of dividends remain more or less constant.

The Total Return – including dividends – is what you must use as a real benchmark for periods of more than 2 years. In fact, all index funds must use this as a benchmark – they are obviously going to buy underlying stocks, and will earn dividends that they, as a rule, have to reinvest.

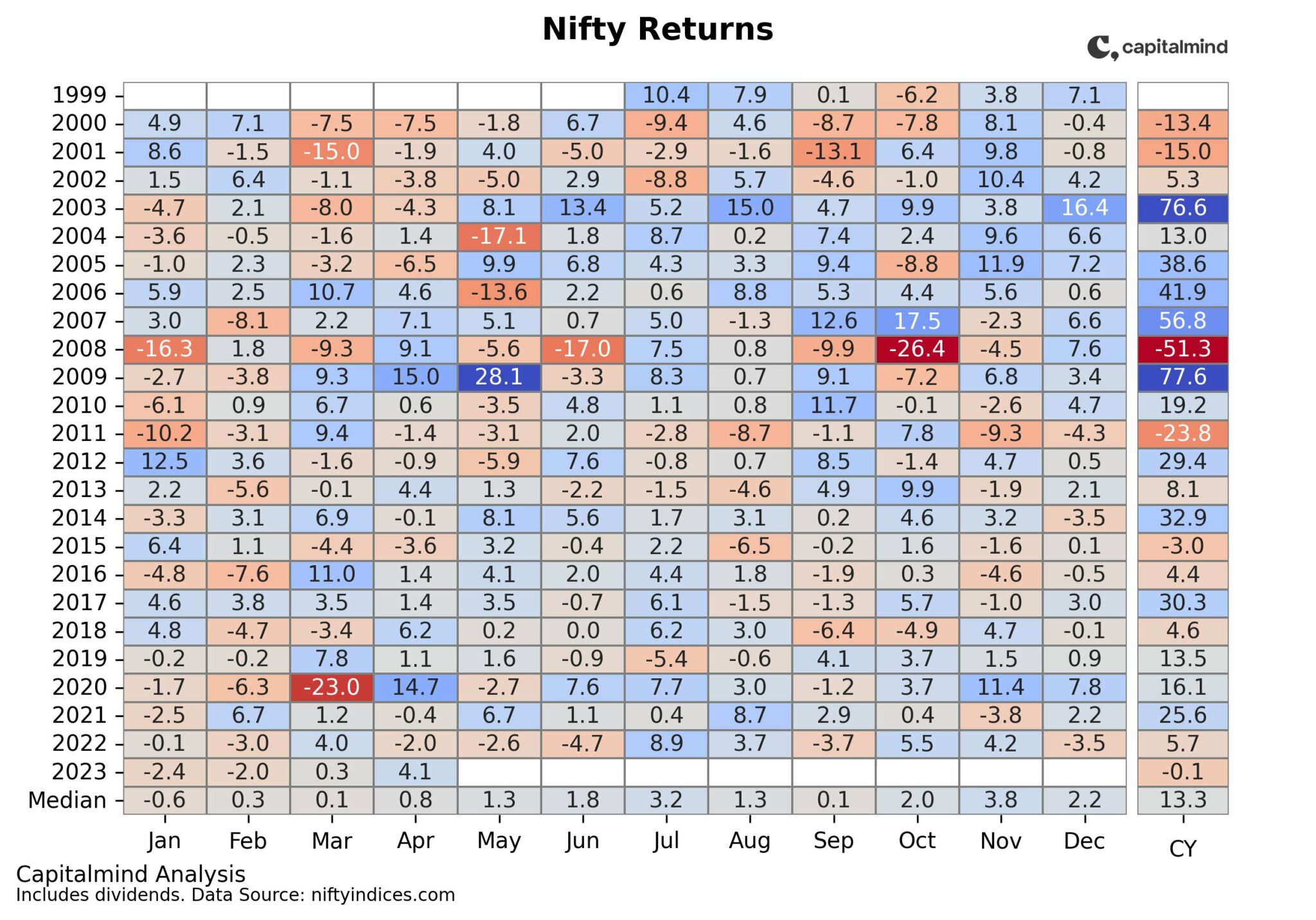

It’s interesting to see how rolling returns have worked over years. That is, how the 5 year return has worked out considering reinvestments as well.

At this point, the 1 year return remains the most volatile and smoothens out as the rolling period increases. (All returns are annualized)

The three and five year returns remain sub-optimal – note: this is a politically correct usage of the term “crap return” – at below 8% which has been the risk free rate of return in this time. The 10 year return is at 21.4%, nearly the highest ever, mostly because the markets were at lows in 2003. (Everything depends on where you start and where you end – lies, damn lies, and statistics.)

And now, coming to a web site you know, is the ability to zoom in and track each of these numbers on a regular basis. More details as I learn something called “Rickshaw” and Javascript and things that make me seem prehistoric.