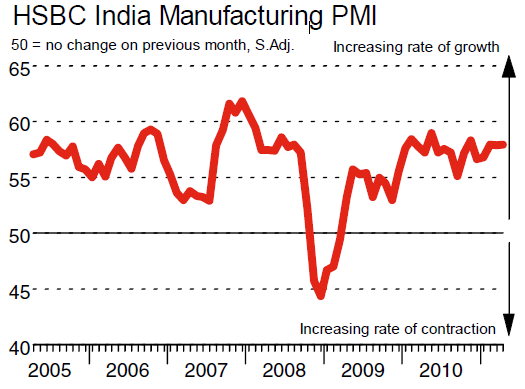

The Manufacturing Purchasing Manager’s Index (PMI) by Markit has a story to tell. First, the Manufacturing PMI stays strong:

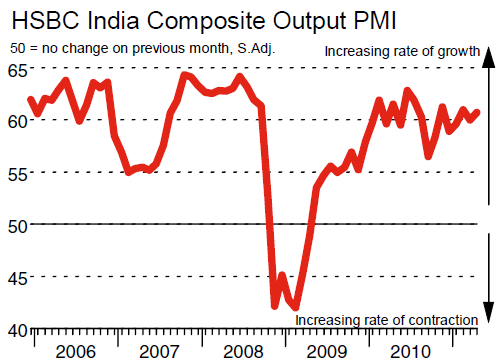

And the composite PMI is still intense, above 60:

(Remember, above 50 is expansion, below is contraction)

Rates of input cost inflation eased across both sectors monitored by the PMI surveys in April, with service providers recording the slowest rise in cost burdens for five months. As a result, the rate of input price inflation at the composite level eased to the weakest since last November.

Indian service providers attempted to offset part of the increase in input costs by raising their prices charged to customers. The pace of output price inflation was solid, and quickened to the fastest for a year. A broadly similar rate of charge inflation was recorded in the manufacturing sector.

(Emphasis mine)

What’s interesting is that we’re growing strongly and there’s output price inflation. This should reverse as the RBI policies take effect.

From a trading perspective, this is a pretty good signal that we have some fundamental strength to the economy. I believe we’re overheating, but the momentum of the past growth can carry us a long way. I would be very careful and selective with shorts.