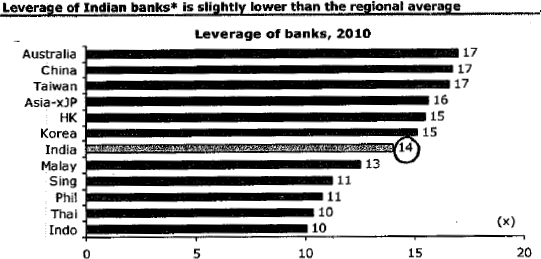

A CLSA report I got by email recently had this graph which stunned me:

Sure, some of our biggest private banks (HDFC Bank, Axis) are actually growing EPS, but are they really worth the overvaluation, especially compared with PSU banks?

The report also says that Indian banks are likely to raise $16 bn (Rs. 70K crore) of equity this year, and they’re levered around 15x on average.

What’s scary is the capital raising itself – plus, we haven’t really seen the end of the losses in real estate eating up bank balance sheets. Gotta be really nimble buying banks.

Disclosure: No positions. Used to be short ICICI but ran out the door when it broke technical resistances. Another post on that.