State Bank of India has a new bond issue out (Shelf Prospectus).

Size: Upto 10,000 crores from retail, but official issue size is 2,000 crores.

Listed: Yes, on the NSE/BSE.

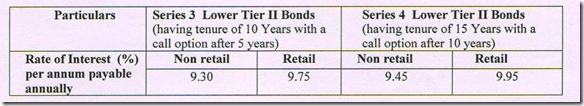

Interest rates:

9.95% for retail on the 15 year bonds, and 9.75% for retail on the 10 years.

Call Option: SBI has the right to buy back the bonds and pay you back the face value of the bonds. The call option is after five years for the 10 year bonds and, after ten for the 15 year bonds.

Tax Deducted at Source: Yes, before annual interest payments.

NRIs, Overseas Corporates, PIOs: Cannot apply.

What about tax: Tax is payable on the interest in full – i.e. the interest gets added to your income. That will pull the net yield down. You can choose to buy and sell on the exchange between interest payments, but the profit is added to your income (as short term capital gain).

What do I think?

This is a great issue for someone looking for a locked fixed income instrument for a long time. Given that fixed deposits are now yielding 10% you may want to think twice, but the 15 year lock-in is fantastic. Sure, they have a call option, but that will only impact the market value of the bond in later years, if interest rates are lower. (Different discussion)

But the cynical me is thinking – why is SBI doing this? They don’t need to. They’re really smart people. Let me reiterate that. SBI has extremely smart people. If they could have offered a lower rate, they would have. That means this is actually a low rate compared to what they expect rates to go to. Meaning, there will be more rate hikes, and the 9.95% that looks good now, won’t look so great if you can get, say, 12% outside. (Don’t tell me 12% is out of reach, please. Even 10% was out of reach a couple of years ago) So that’s the risk – the feeling of regret if rates go up to 12% – in fact, you will think of it as a "loss" because the market value of the bonds will be below par, in that case. But if you have a different view on interest rates or can swallow such regret, go ahead.

The full prospectus and application forms etc. will be available shortly. More info then.