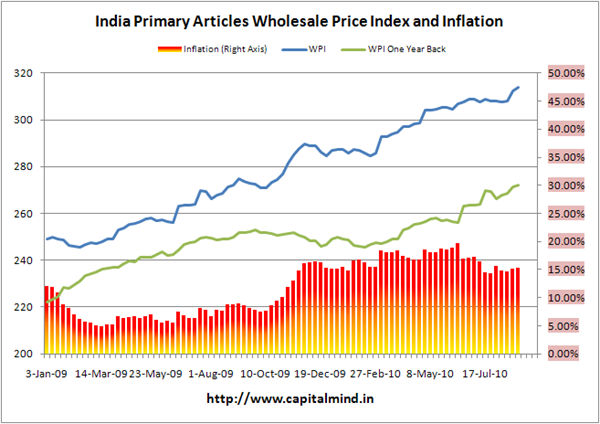

Primary Articles Inflation – which is mostly food – is now up to 15.4% on August 28, 2010, with the index at an all time high of 314.

What’s still scary is the past revisions – data is revised about two months after the initial release. The primary articles inflation on July 3 has been revised to 17.31% from the earlier reported 16.25%.

While the amount of discrepancy has narrowed from 2% to 1% it still remains too high. We shouldn’t have more than a few basis points of difference, really – and what’s more of concern is, are we really at higher levels of inflation today?

Note: Good rainfall. Maybe too much. Still, should help supply problems. The Government of course is CREATING supply problems by buying up veggies and letting them rot.

Posts on Inflation:

- Sep 4, 2010: Inflation: Primary Articles at 15.2%

- Aug 27, 2010: Food Inflation at 14.75%, Scary Revisions of 2%+

- Aug 16, 2010: June Monthly WPI at 262.5, Inflation at 9.97%

- Aug 3, 2010: Deflation is Really Bad: Or, What Is Krugman On?

- (More on Inflation)