Reliance Industries (RIL) has been continuously going south the last few days and this warrants some attention. This is what Reliance Looks Like:

This is quite amazing really – six continuous down days, kissing the lower Bollinger band, way below moving averages, and MACD so negative it’s scary.

There’s a reasonable support at 975 and a one year low at 955 which should act as a secondary support. Right now it needs to bounce off those levels, and there’s talk in the markets of managers exiting because performance isn’t all that great.

I like the stock on a fundamental basis. The folks are huge on oil and energy – whose prices are going up. They have a lot of cash, which again is helping them acquire new technologies and to scale. They have invested in BWA and can be a huge game changer in the next five years. Recent results were very good – Rs. 14.8 EPS versus Rs. 11.55 last year, a 27% growth, in what is the largest company by market cap in India. Even if on a technical basis, this is weak, there’s honestly no long term difference in buying at 970 or 1100; if the projected growth of the company is as strong as I think there is substantially higher value in the stock.

Yet, there’s more to this because RIL is the biggest piece of both the Sensex and Nifty. When have we seen such a breakdown earlier? Take a look:

This is June 2008. Then what happened?

First, the stock recovered to hit the 20 day MA, and then flattened back for a while till Lehman said goodbye, when it went “crash” again.

The difference is that the last time around volumes peaked around the recovery time at nearly 2x average, and we need to see that happen before you time a recovery, even to retrace to 20 MA, currently around 5% above today’s levels.

Technical charts are useful indicators of sentiment and/or money-flow. In this case, when the market’s near a 2 year high, and RIL is the biggest stock in the indices, there can be no real lack of positive sentiment; it has got to be money flow. But – no bulk or block deals on the NSE in the last 15 days. Turnover averaged 500 cr. a day in the last few days. Delivery volumes were 60% averaged in the last few days – it’s about 48% on 11th, again, nothing substantial to note there.

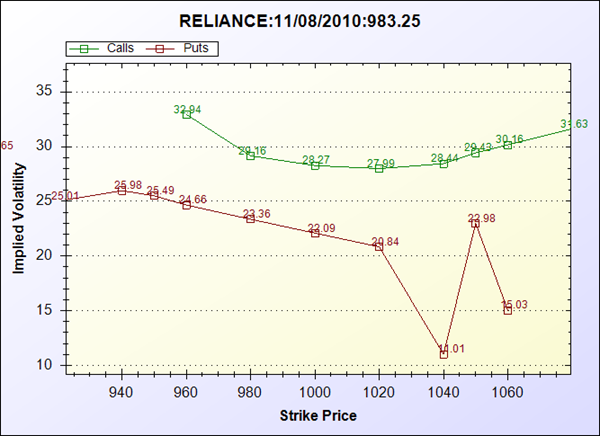

And, strangely Reliance Puts have a lower implied volatility (the measure of time value) than calls. This is inverted – for a falling stock, it should be the other way around! People are selling Reliance puts at lower values relative to the calls, when the stock’s fallen

(Note to Dev questions: I wrote this tool that does option IV charting. It’s part of a software product I’m building.)

And the Reliance future still trades at a premium, and is continuing to do so – though it’s narrowed to 5 points.

While this may sound strange – the really strong stocks like Tata motors and ICICI Bank are trading at discounts in the futures market.

It’s altogether difficult to say which direction RIL will go, and because of it, the indices. I think what we should see is – a heavy down volume day, and then a recovery to 20 day moving averages. The support levels are important in that if the heavy volumes hold supports, we should see a rise. If it breaks 955, then we should quite easily see 915 on the stock. Odds wise I’d think of buying a call on the high volume down day, or buying the future at support. Selling calls or buying puts on a breakdown below 955 is the other strategy.

[Yes, that’s a long post to say “I don’t know”, but that’s how trading is – you react, you don’t predict, and you watch.]

Sorry for the highly technical posts. I can explain better using video – that’s what my new startup is about. But let me know if you have specific questions, or comments.

Disclosure: Hedged semi-longish position on RIL.