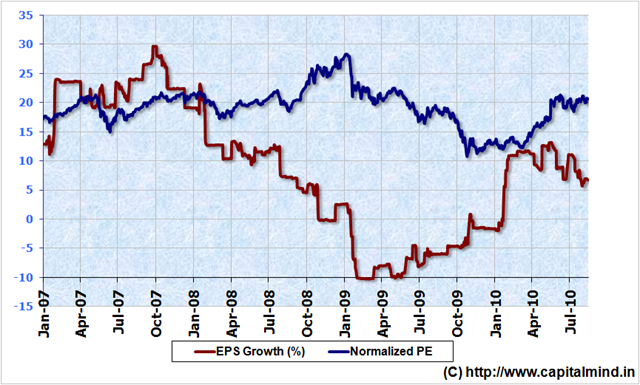

Nifty’s EPS growth has just not happened, again stagnating at 238, a growth of 6.76% over last year. The current P/E ratio is 22.76.

This is after most of the Q1 2011 results are in, and we saw exemplary growth in the economy. Are the top 50 companies so far distanced from our economy?

On a normalized level (taking the P/E of last year, versus actual growth seen today) here’s the distressingly widening gap. The blue line is the P/E last year (the “Expectation”) and the maroon line the actual growth this year (the “Reality”). Markets have in the last two years been terribly optimistic.

In the past, EPS growth peaked about one quarter before the markets fell,and we see a relative EPS growth peak in May 2010; is this the time that markets start to underperform (compared to say fixed deposits)?