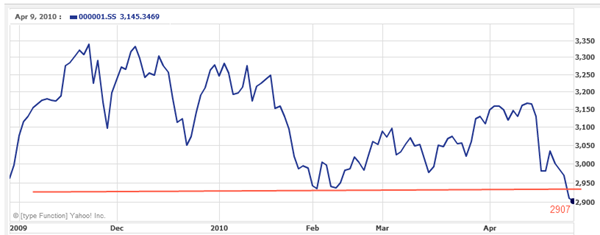

Why is the Shanghai Index at or near 6 month lows?

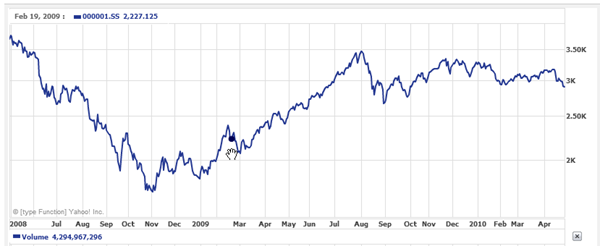

The two year chart shows us we have a LONG way to go, of course. Just to give you a context:

Yes there are some fundamentals – banks have been asked to cut back on loans, real estate is heating up etc. They’ve never mattered this much in the past, so why now?

China is strange – it peaked in Oct 2007 and started falling seriously a week before India did in Jan 2008. It also started its rise in Feb 2009 a few weeks before India. But these are too few data points, can’t read that much into them.

I’m not very bearish right now – though my system is only throwing out short calls for some reason and getting whipsawed into oblivion. Still, I can’t imagine Greece will be huge because Germany has it’s own selfish considerations with the Euro to let the games stop. US reports are all good – their economy is improving although they have to survive some tough hits later this year. Gold is inching up, and is going to test the $1200 mark soon.

I don’t like this period. It’s like a lull before a storm. It has been too long now in a sordid range, and there are a LOT of players short volatility (i.e. writing deep Out-of-the-money Index puts and calls). But that game can take forever to unwind; in this market, everyone is on tenterhooks so there will be whipsaws. Maybe it’s time to stop looking for trends and go for mean reversion? I.E. Buy every dip, and sell every rise? These are famous last words, though.