Info Edge (NAUKRI) continues to astound me. They’re literally flatlining EPS for the last six quarters, and yet, command a P/E of 35!

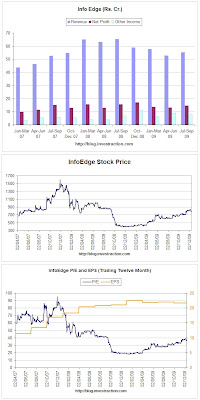

To talk less and show more, here’s a graph of their revenues, stock price and PE/EPS comparison.

(Click for a larger image)

- Revenues have flattened since Jan 2008, and aren’t recovering much at all.

- “Other Income” forms a substantial part of their profits even today. The most recent quarter had 14.74 cr. of net profit, and they had “other income” of 8.35 cr. The business literally hinges on the other income figure!

- They have around 320 cr. in the bank, going from their recent financial statements. That is generating most of the other income – at 8% yield you’ll get about 6 cr. per quarter of income.

- Other income is useful, but paying 35 P/E for a company whose biggest contributor to the bottom line has been other income for the past four quarters is, in my opinion, crazy. They might as well return the money to investors if they aren’t using it. (The cash comes to Rs. 115 per share)

- Look at the EPS – it’s flat throughout. The last two quarters add up to a measly Rs. 10.27, and the earlier financial year was Rs. 21.87. No serious growth in EPS since last year.

- But as you see the stock price and went up beyond 800 and a P/E ratio of nearly 40 – it has since dipped to 770 and p/e of 35. But such a high P/E for a stock which has barely grown in the last two years – very surprising.

- Like in 2007-08, the annual report for 2008-09 also contains a scary piece of information: If option grants were calculated using “fair value” versus “intrinsic value”, profit would have been lower by Rs. 10.8 crores and the EPS would have been Rs. 17.91, nearly 1/5th lower than the 21.67 they reported.

- Insiders have been consistently selling over the last year. Some Info Edge insiders seem to have sold between 5-20% of their holding over the last year, but note that usually insider sells don’t mean much to stock prices.

Maybe people expect great things of Info Edge, but it’s been a disappointing set of results so far. The stock meanwhile doesn’t give a damn; it’s near 1 year highs. But at some point all this optimism must translate into numbers, no?

(Related: All Info Edge Posts)