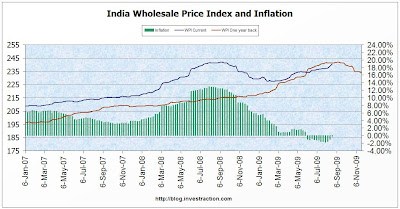

A quick look at the latest inflation chart:

(Click for a larger image)

We’re just a tad off the all time highs in the WPI. What happens now? Two alternatives, in my humble opinion.

One, that inflation will go back to it’s normal rise – although the inflation rate is still negative, the WPI is rising. It’s only not as much as last year, and as you can see, that situation is on the verge of not being true anyore. This recent rise is just about meeting the longer term trendline, meaning that if we didn’t have the zoom up last year, and a zoom down earlier this year, inflation’s just about where it would have been if it followed the trend of the earlier few years.

Looking at the drought, the high sugar prices and the fact that WPI is highly weighted on food, this is the most likely situation in the short term. But due to the dip in WPI in the few months from October 08 to Feb 09, we will likely see inflation hitting relative highs of 10% or more. No one likes that, so there will be pressure on interest rates – whether the RBI will bite the bullet and hike rates is a matter of conjecture. Another thing to see is if this spooks traders into hoarding – who doesn’t like a good short term profit – and what the government will panic itself into doing. Lastly, the return to the longer term trend necessitates the return of true GDP growth back to the old trend of 8%+ – otherwise the system kinda falls apart.

Second alternative, that commodity price rises we have seen recently, in copper, iron etc. will reverse. Why? I’ve mentioned recently that the Baltic Dry Index is falling at an alarming pace. It’s a proxy for commodity prices, and could be a leading indicator. Additionally, China’s worries seem far from over; their surge in bank lending due to the “stimulus” packages has pushed money into speculative avenues, like stocks and commodities. Even the government owned companies stockpiled raw materials as much as they could. That seems to be coming to an end, and it’s starting to hit asset and commodity prices – if that trend continues, global commodity prices can come down dramatically. Some of this will be offset by relatively high food prices in the next couple months in India, but eventually the drop will show in our WPI as well.

Which of the above two? Or are there third/fourth alternatives? (Conspiracy theories are welcome, happy to be entertained. I’ve got Indo-China-Pak war, politicians owning mines who want commodity prices to stay up etc.) Time will tell.