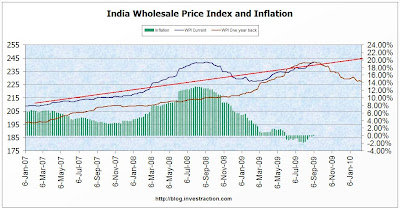

A little late perhaps, but the most recent inflation chart:

(Click for a larger image)

If the prices continue at the long term trend levels we will see index levels of 245 in JFM 2010. That corresponds to the 2009 levels of about 228; inflation will be around 7.5% then. Will the RBI be pressured to raise rates?

Food price inflation has been around 15% already, and sugar prices have gone seriously up worldwide. Wheat, while decreasing worldwide, has held steady (despite a pretty good supply this year). And the dollar has stayed at the 48 levels, regardless of what people say is “liquidity” and “inflow”. The RBI seems to be actively intervening – what else can explain the $5-6bn we add every week to the reserves. But in the face of rising inflation a weaker dollar will help since most commodities are marked to international prices. But again, will the RBI bite?

It’s an inflexion point for the economy, in a number of ways.