Rediff’s article: Stay calm, don’t panic by Anil Rego try to mollify investors who got in at the peak of a bull run that it’s all ok, the Sensex recovered really fast after that.

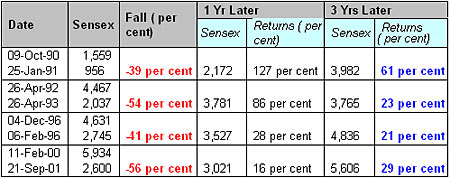

As one can see, someone who invested in peaks, saw troughs, but if s/he had waited patiently would have gained significantly from the stipulated levels at which s/he had bought. Another key point to note is that the deeper the cut, longer it took to heal.

Unfortunately, this makes little sense for those that got in at the peak of the bull run.

Look at the results one or three years later. In two instances (1992 and 2000), even after three years, the returns were negative from the peak. In 1996, the returns after three years was even – only in 1990 did it grow substantially. (But remember, three years after 90 was the end-game of a very dramatic bull run too, and the index subsequently went even lower)

Looking at the current market – even today we are up 30% from the lows of 2250 on the

Nifty, but does it count for much? Will it go 30% from HERE in three years? The data, as shown in the article, seems quite unattractive; on an average if the index only recovers 50-60% from the lows in three years, the return from today is an abysmal 7-8% a year compounded.

Data can be twisted to look really good; the article will make those that invested at the bottom happy – all the four of them. But there’s little solace for those who got in at the top, most of whom are hoping to get out “at cost price”. The opportunity cost today is a 8% per year one could get post tax in other, just as risky instruments like the Tata Motors bond issue.

This is just a WTF.