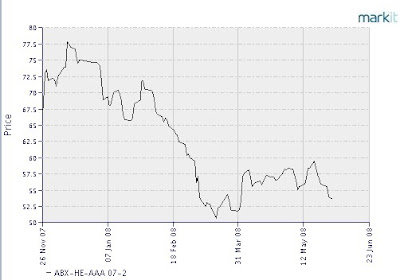

The ABX HE indices, which basically shows prices at which home asset backed securities are quoting, are sliding downwards again.

This is the ABX-HE-AAA-07-2 index – approximates prices of AAA rated securities against home mortgages, sold in the second half of 07.

This is AAA, and quoting at 54 cents to the dollar. The subprime indices of nearly all of the last two year mortgages are quoting at less than 10 cents. All the values are at or near all time lows, and the slide is apparent in the last week or so.

The first set of dips was noted in July 07, and in Nov 07 I wrote about it. Heck I was scared of a fall to the 83 levels at that time – today it’s literally lost 40% more.

In Feb the next serious dip happened, and soon, Bear Stearns was bust.

Since then we’ve had the fed reducing rates, some recovery, a fall again, further reduction by the fed, providing more and more liquidity, and even allowing such AAA securities to be pawned to the fed in exchange for money.

The Fed rate is at all time lows, and still, foreclosures stay very high – and home prices are going south.

Is this the beginning of the third wave? Should we prepare for more bad news? How do we get impacted in India? Let’s wait for it to unravel. The answer is always apparent in the price first, and then in the news.