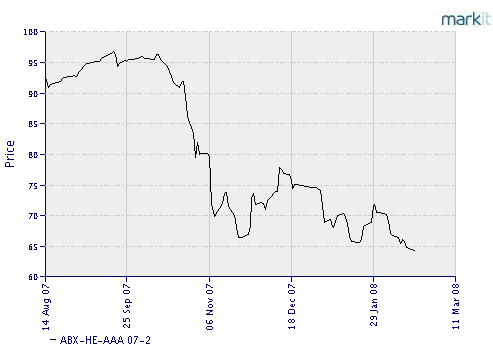

The Markit ABX indices, which are based on asset backed securities, are trading at new lows.

This is the graph for the ABX based on loans (rated AAA!) made in the second half of 2007. This sorta means people are willing to pay 65 cents to the dollar for such loans. So much for AAA.

Note that without too much drama the indices of nearly all the tranches are at new lows. If this stays so, there are more writedowns coming.

India is going to see a lot of funds flowing out. Means dollar will rise. See it’s already above Rs. 40. What can you do? Maybe buy the small IT companies that haven’t hedged. Who? Patni? Mindtree? Someone at low valuations with hedge numbers low enough to warrant interest. Ideas?