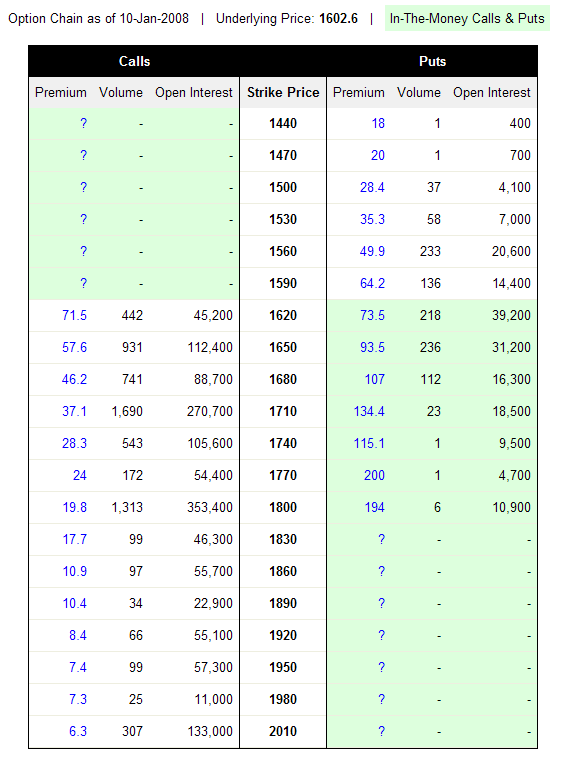

Infy results are out tomorrow and there seems to be substantial action in the call options of the stock. The 1710 call open interest has nearly doubled in a day, and the 1800 call continues to be the one with the highest open interest, around 350,000 shares.

This is when the stock is down 3% so it could either be covered call writing – which means people write in the money calls as the stock goes down, in order to cover their future position losing money. You keep the option premium on a call option when the stock goes down in value, and that will offset losses on the long position in the future. (Covered calls = buying a future and selling a call)

A spike in the 1710 call and the 1800 call trading at such high premiums does not quite imply that. Why? Because across the option chain these have extremely high implied volatilities, both 50% or more (calculated at 6% risk free interest rate)

Now abnormally high premiums or implied volatility typically mean buying, not selling. (When more people try to sell, the premiums go down and it reflects in lower implied volatility) Now given implied volatilities are high, who are buying?

It could be people hoping that Infy, as usual, will provide a stellar result. And then it could be those that KNOW – some news could have trickled out and people went gung-ho buying the options rather than the stock. The stock itself shows no great volume breakouts. Could this be insider buying, people preferring to buy options instead of the stock or the future? Or is this just regular action one day before results?

A good result by Infy will make the calls in the money – one would think. But bad numbers or guidances will drive the stock lower. In the first case the option volume increases are interesting, in the second case, they are not. Will Infy show stellar results? Is there anything in the option action that we can use in the future? Let’s wait and see.