To continue from Part 1, Here’s an explanation of the rest of the fields in ITR-1.

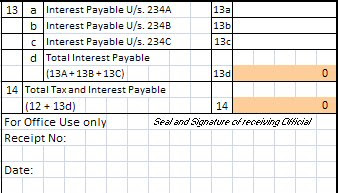

If you don’t pay tax on time the Tax Inspector wants you to pay interest. But they give you clinical names for the sections for which interest is charged. Let me decode them for you.

- Field 13a, Section 234A: means interest if you file your return late. If you have not filed your return before July 31 then you pay 1% per month of delay. (Note: If you file on September 15, you pay 2% as interest, not 1.5% – it is not pro-rated) Also, this applies on any tax that is payable as of July 31 – if your taxes are fully paid, you don’t have to worry. Please file your returns in any case by March 31, 2008 – as after that there is a Rs. 5,000 fine.

- Field 13b, Section 234B: Interest on failure to pay advance tax. If you’re a salaried employee paying TDS (or if your interest receipts are getting tax deducted on them) you should be safe. Essentially this section means: You should have paid 30% of your total annual tax by Sep 15, 60% of it by December 15, and 100% of it by March 31. Interest of 1% per month applies.

- Field 13c, Section 234C: Same as 234B, except this section applies when the advance tax is SHORT of the actual tax payable. (Means some advance tax was paid, just not enough). Note that this section does not include any capital gains that you were not able to estimate earlier.

Field 15a: This refers to the advance tax paid, and should come from the section below (Item 23) where you fill in details of advance tax.

If you have NO idea what advance tax means, here’s a quick explanation: You are supposed to pay tax when you receive income, not at the end of the year. For salaries, some tax is deducted at source (TDS). For any other receipts like interest or consultancy income, only part TDS is deducted. You are expected to figure out how much your TOTAL tax liability will be at the end of the year (extrapolating your income and expenses) and then pay:

- 30% of total tax payable by September 15

- 60% of total tax payable by December 15

- 100% of total tax payable by March 31

If the TDS amount falls short of such percentages, you can pay advance tax – most banks provide you this facility. You fill up a challan with your pan number and such details and then pay the amount, and collect the counterfoil back.

Field 15b: This is the sum of all TDS paid on your behalf. Includes TDS paid by your employers, bank or other such organisations when they have to pay you something.

Field 15c: If you paid tax post March 31, 2007, it is no longer called “Advance Tax”. It is called “Self Assessment Tax” (Don’t ask me, I didn’t write the rules). You must fill in such tax paid here.

Refunds

Some of you may have paid more tax than necessary. In such situations, you will require a refund, and here’s the section where you fill that in:

Items 18 to 20 apply to refunds and are mandatory. Type in your Bank Account number, Type of account (Savings/Current) and MICR Code (the 9 digit number on the bottom of each cheque, next to the cheque number).

Fill in details of Tax Deducted at Source. For Salaries you should receive a Form 16 from your employer(s). You will get a Form 16A for TDS deducted on interest income. Fill all the fields as given in the forms you receive.

Advance Tax and Other information

Fill out advance tax details – BSR code and challan serial numbers are available on the challans (counterfoils) your received when you paid tax.

Other information includes certain key information that the Income Tax has started collecting this year. They expect you to fill out amounts against the codes in this manner:

- 001: Cash deposits into a bank account, of Rs. 10 lakhs or more. This is not amounts by cheque. It’s only the amount paid in cash.

- 002: Payments against bills for a credit card, of more than Rs. 2 lakhs a year. This is an aggregate amount, so even 20K per month on a single card meets this criteria. Enter the total amount.

- 003: Payment for mutual fund units aggregating Rs. 2 lakhs or more. I believe this is towards units of a single fund scheme (but please confirm with an accountant). This includes any “dividend reinvestment” in a scheme.

- 004: Bond or debenture purchases of Rs. 5 lakhs or more.

- 005: Payment for Rs. 1 lakh or more of shares in a company. This applies only to shares of the same company and from Rule 114E, it seems that this only applies to shares applied in public issue such as Initial Public Offer (IPO).

- 006: Purchase of Rs. 30 lakh or more worth of property. NOte that this field must be filled even if you took a loan to buy the property.

- 007: Sale of property worth Rs. 30 lakh or more.

- 008: Purchase of RBI bonds worth Rs. 5 lakh or more.

When you should not file ITR-1

- If you have income from business or profession (such as Google Adsense) – Use ITR-2, 3 or 4.

- If you have income from capital gains (long or short term) – including from sale of shares, property, gold or such capital assets. Use ITR-2.

- If you want to claim the Rs. 150,000 exemption on interest paid for a housing loan. You should use ITR-2 for that.

Download the ITR-1 Excel file here.

Note: the sheet is “protected” in Excel, so you can only select fields which I believe you should use to enter data. If you really need to change other cells, use Tools menu | Protection | Unprotect sheet and make your changes.

That pretty much does it for ITR-1. I hope my posts have been helpful.