I talked about common items in the Income Tax Return forms, and now here’s how to fill the rest of the form.

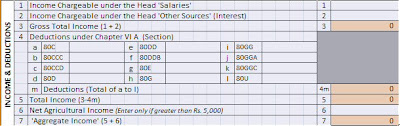

- Fill in your salary as given in your Form 16. You do not need to attach the form 16 with this return. For those of you that have multiple employers in the financial year, add all the salaries up and put in the total here.

- If you have interest from Fixed Deposits, savings bank interest, or other such sources – this must be entered here. Don’t assume you have no interest – please get an interest statement from your bank. If you have received interest of more than Rs. 5,000 banks will deduct TDS, and give you a Form 16A. In that form the “Interest earned” will be mentioned – total up all the interests received if you have more than one source, and put the total in this field.

- Gross total Income is the sum of 1 and 2 above. In the Excel sheet this is automatically calculated and thus coloured orange.

- Section 4 contains all sorts of deductions.

- Most of you will have 80C deductions, like:

- Public or Employee Provident Fund (your contribution, not your employer’s)

- National Savings Certificates (NSCs)

- Insurance Premium payments

- Tution fees (upto two children, only tuition fees – no donation or such)

- Principal repayment of a housing loan

- Five year Fixed deposits under 80C deductions

- ELSS mutual fund purchases

- Other such 80C deductions (refer to the act)

Note that the total amount of all the above allowable for deduction is limited to 1 lakh.

- 80CCC refers to certain pension fund purchases. If you have such a fund this section will be mentioned in the document of purchase.

- 80CCD is for purchases of central government pension schemes.

- 80D: Upto 10,000 a year paid towards medical insurance premium for you, your spouse, dependant parents or children.

- 80DD: deductions for taking care of disabled dependants

- 80DDB: Upto 40,000 paid towards treatment of certain diseases like cancer, AIDS, Renal failure etc. (Certificate from a doctor in a government hospital is required. Don’t attach it with the form, but keep it in case they ask)

- 80E refers to interest paid for higher education loans.

- If you donate money to certain charities or funds, 80G deductions can be claimed.

- 80GG: If you don’t get Housing Rent Allowance (HRA) from your company, You can get a deduction of actual rent paid upto 2,000 per month, if rent paid is greater than 10% of your income. This is a simplified explanation, read the section for details.

- 80GGA gives you deductions if you donate to certain scientific research or rural development. (Yes, it’s a complex section)

- 80GGC allows deductions for contributions to political parties. (Wow)

- 80U allows certain deductions to disabled persons.

Note that I have not provided complete details – I am not a chartered accountant, and you may need to use such an accountant to help you with more details.

- Most of you will have 80C deductions, like:

- Total income is calculated as the sum of salaries+interest minus all deductions.

- If you are a farmer, like Amitabh Bachchan but hopefully less controversially so, please enter your agricultural income here.

- Aggregate income is the sum of all your income.

Tax Computation

The next section involves computing your actual tax.

Field 8: The tax payable is calculated in slabs. For the first Rs. 100,000 of your income you pay no tax. This limit is Rs. 135,000 for women and Rs. 185,000 for senior citizens.

For the amount from 100,000 to 150,000 you pay 10% of whatever is greater than 100,000. (Lower limit is 135,000 for women and for senior citizens this section does not apply)

From 150,000 to 250,000 you pay 20% of whatever is above 150,000. For senior citizens, the lower limit is Rs. 185,000.

You pay 30% of whatever is above 250,000.

Examples:

For a salary of Rs. 125,000 (male):

Upto 100,000: No tax

Slab 1: 100,000 to 125,000: 10% tax on (125,000-100,000)=Rs. 2,500.For a salary of Rs. 240,000 (woman):

Upto Rs. 135,000: No tax

135,000 to 150,000: 10% of 15,000 = Rs. 1,500

150,000 to 240,000: 20% of 90,000 = Rs. 4,500

Total Tax: Rs. 6,000For a salary of Rs. 400,000 (senior citizen):

Upto Rs. 185,000: No tax

185,000 to 250,000: 20% of 65,000 = 13,000

250,000 to 400,000: 30% of 150,000 = 45,000

Total Tax: 58,000

Field 8b: Mention your agricultural income here, if any.

Field 9b: If you have an taxable income of more than Rs. 10,00,000 (10 lakhs), you must pay 10% of the tax as a surcharge. (Actually you need to have a taxable income of Rs. 10,25,773 for this surcharge to apply)

Field 9c: 2% of your tax (plus surcharge) is additionally payable – put the amount here.

Field 10 and 11: There are specific deductions available for salary paid in arrears or as an advance in a year under section 89. Section 90/91 refers to double taxation agreements with other countries, which allows you to claim tax relief for taxes paid abroad on income earned abroad.

I shall have to continue the rest in another post since this is getting too long. Please post me your comments.

Download the ITR-1 Excel file here.

Note: the sheet is “protected” in Excel, so you can only select fields which I believe you should use to enter data. If you really need to change other cells, use Tools menu | Protection | Unprotect sheet and make your changes.